Arab refugees in Germany, especially Syrians, ask them for any way to obtain a bank loan for the year 2022 in order to secure their living expenses, invest in any project that brings them return, or continue to live and stay in Germany.

Through this article in its blog, a full explanation is provided about what are the easiest and fastest ways to obtain bank loans from Germany. This article addresses the category of Arab refugees, especially Syrians, Iraqis, and some communities affiliated with Saudi Arabia, Qatar and the UAE, as well as Morocco, Tunisia, Algeria and many Arab countries. other.

With the aim of studying in Germany, what is the guarantee for withdrawing these loans and how, oh, the way in which these loans are withdrawn from banks, and what are the conditions imposed by banks on loan applicants? What is the financial cost of withdrawing the loan? What are the advantages or opportunities offered by banks to those requesting loans? What is the cost of the fees for applying for a loan to study pharmacy in Germany? What are the rest of the steps and needs?

How to get a loan for foreigners in Germany?

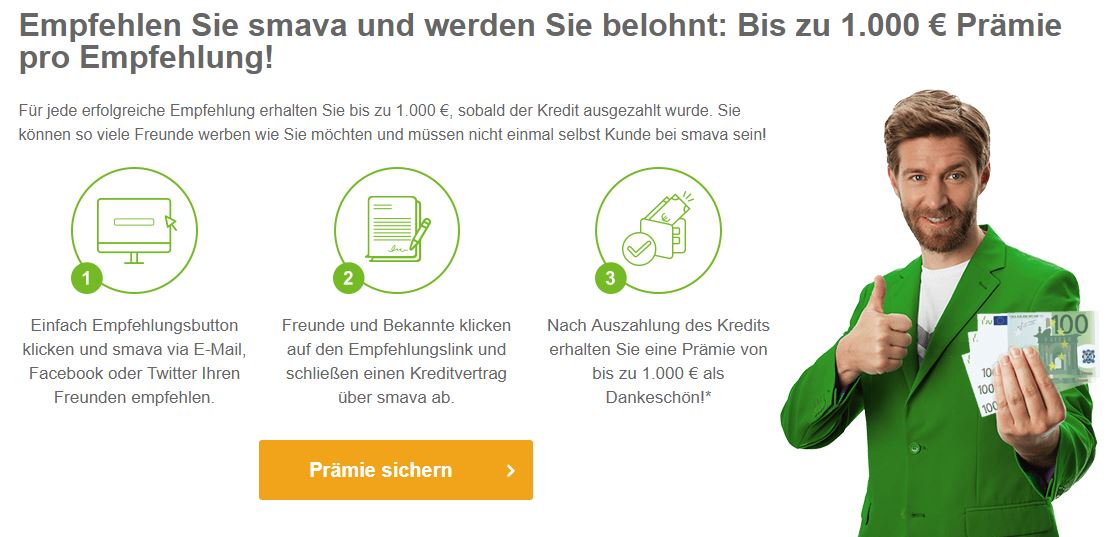

The applicant must present to the bank management all guarantees that guarantee the right of the bank. The application is submitted by a German company called Sava, which is considered one of the best and most advanced companies affiliated with banks in Germany, in addition to being one of the companies that borrow financial security in Germany for non-Germans during the year 2021.

Services and information provided by the loan company SMAVA in Germany

- It is considered one of the best credit companies that allow loans to be given in Germany.

- It was established in 2007 and includes and includes more than 500 workers and employees.

- It grants more than 500 loans to its clients every 3 months.

- The company can receive requests from clients requesting loans, the company can receive 700 requests within 3 months.

- The company can give refugee loans very little profits and interest.

Documents required to apply for a loan from Safe

Apply to the company through the website, and record all the required data in the application papers, namely:

- Applying the actual direct objective, which made the individual submit the application to the bank, and what is the method by which the loan can be withdrawn from the bank?

- Record all comprehensive data that pertains to information about the applicant for the loan, which is the full name of the customer and the address to which he belongs.

- Knowing the amount that the borrower wants to borrow from the bank, and how it can be repaid.

- Apply for the value of the monthly salary of the individual applying for the loan.

Advantages of a German loan for foreigners

- One of the advantages of the German loan is that it is the highest bank to provide a percentage of loans, which is from the beginning of the 500 euros to the rate of up to 120 thousand euros.

- It does not charge customers large profits compared to other banks in the European system.

- It does not require the provision of difficult guarantees in order to obtain the application for the loan, and the application is approved in an easy and simple way, and the simplest guarantees are satisfied.

Fees to pay for a loan in Germany from Safe

- With regard to loans provided by students, the benefits are very simple, and do not exceed 1% every 1,000 euros.

- As for other foreign nationals, the fees you demand are 1.9% for every 1,000 euros.

- The percentage on the purchase of cars or real estate is 2.3% per 1000 euros.

Student loans for foreign and Syrian refugees from Savva

Students and the devices of many obstacles and obstacles in the recent period in preserving their living expenses and the duties responsible for them, and thus the result was that the students gave up their evening jobs that they used to practice after the end of the school day and official holidays, which made them accept German bank loans.